The carbon dioxide removal (CDR) market is experiencing unprecedented momentum, with sales reaching record highs and projections pointing to substantial growth by 2034. As corporations and governments intensify efforts to achieve net-zero goals, innovations in CDR technologies are gaining traction. Key developments, such as Verra’s strategic partnerships for enhanced registry transparency and approvals from the Integrity Council for the Voluntary Carbon Market (ICVCM) for methodologies like biochar and improved forest management (IFM), are bolstering market credibility. These advancements signal a maturing sector poised to play a critical role in global climate mitigation.

Understanding Carbon Dioxide Removal (CDR)

CDR encompasses a range of technologies and practices designed to extract CO₂ from the atmosphere and store it durably, complementing emissions reductions. Methods include direct air capture (DAC), bioenergy with carbon capture and storage (BECCS), biochar production, enhanced weathering, and nature-based solutions like afforestation. Unlike traditional carbon offsets that avoid emissions, CDR actively removes existing CO₂, making it essential for addressing residual emissions in hard-to-abate sectors. The market’s voluntary segment (VCM) has seen rapid adoption, driven by corporate net-zero pledges and regulatory incentives. In 2024, CDR accounted for 86% of durable carbon removal deliveries, with biomass-based approaches like biochar dominating due to their scalability and cost-effectiveness.

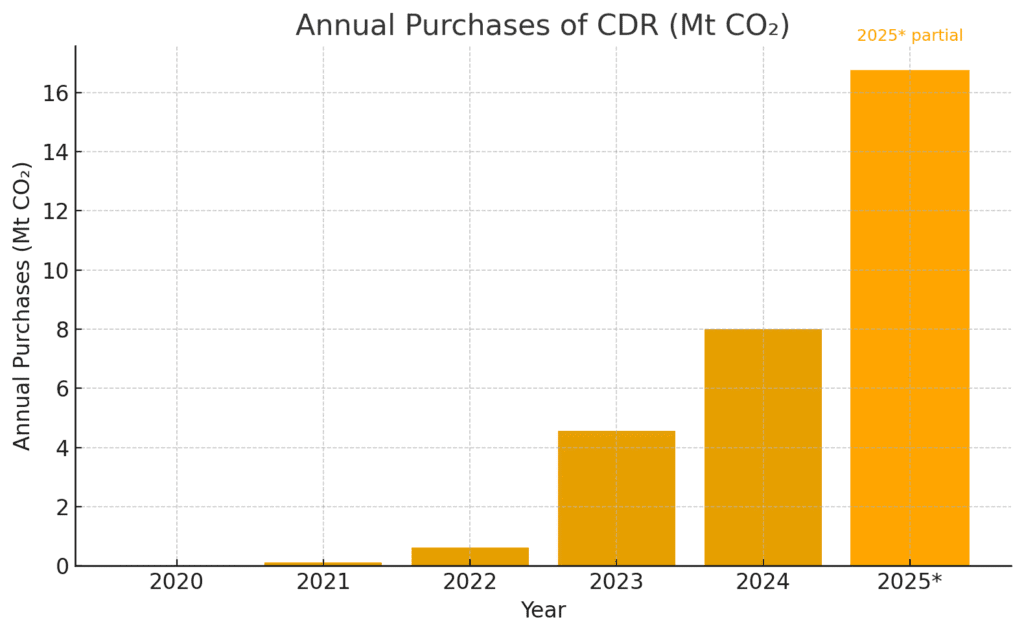

Record-Breaking Sales in 2025

The CDR market has shattered records in 2025, with 16 million credits sold in the first six months alone—marking the strongest start to any year on record. This surge is fueled by major buyers like Microsoft, which aims for carbon negativity by 2030, and a shift toward biomass-based removals that now comprise about 40% of credit volumes. Globally, CDR credit sales have risen dramatically, from just 120 metric tons in January 2020 to approximately 12 million metric tons by mid-2025, though this still represents less than 1% of the 10 billion metric tons needed annually by 2050 to meet Paris Agreement targets. The momentum reflects heightened corporate demand, with financial services and technology firms leading purchases—tech companies alone have bought over 50 million credits to date. Half of 2025’s buyers are first-timers, indicating broadening market participation.

Projections: Scaling to $2.85 Billion by 2034

Market forecasts underscore CDR’s explosive potential, with the sector valued at $842 million in 2025 and projected to reach $2.85 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.53%. This expansion is driven by increasing investments in high-integrity removals, government incentives like the U.S. 45Q tax credit, and demand for durable credits that could hit $14 billion by 2035. DAC leads with 67% of 2023 revenue and is poised for the fastest growth due to its flexibility. However, success hinges on transparency, regulatory support, and overcoming challenges like high costs and political instability. By 2030, demand for CDR could range from 40–200 million tonnes of CO₂ equivalent annually, emphasizing the need for scaled infrastructure.

Enhancing Transparency: Verra’s Partnership with S&P Global

Verra, a leading carbon standard, has partnered with S&P Global Commodity Insights to launch a next-generation registry platform, integrating Verra’s project hub with S&P’s Environmental Registry software. Announced in August 2025, this collaboration aims to improve traceability, accessibility, and performance in carbon markets, with features like seamless data integration, customizable reporting, and support for Article 6 compliance. The first phase, set for launch in Q1 2026, will enhance transparency and trust, addressing past criticisms of the VCM and facilitating easier credit issuance and retirement. This move is expected to accelerate market integration and attract more participants, particularly in regions like Africa where carbon credits are vital for sustainable development.

ICVCM Approvals Bolster Credibility

The ICVCM has approved several Verra VCS methodologies, including three for biochar and two for IFM, deeming them compliant with Core Carbon Principles (CCP) for high integrity. Announced in August 2025, these endorsements cover Verra’s VM0044 (Biochar Utilization), VM0037 (Biochar Production from Residual Biomass), and VM0047 (Afforestation, Reforestation, and Revegetation), among others. Biochar methodologies focus on converting biomass into stable carbon for soil enhancement, while IFM emphasizes sustainable forest practices to boost sequestration. These approvals build on prior VCS validations, strengthening buyer confidence and enabling CCP-labeled credits to command premiums in the VCM.

Implications and Future Outlook

The CDR market’s growth and integrity enhancements are pivotal for achieving global climate targets, with durable removals like biochar and DAC blending with nature-based solutions for comprehensive impact. Rising regulations in Europe and U.S. incentives are phasing out low-quality credits, fostering a transparent ecosystem. Challenges remain, including supply constraints and public awareness, but opportunities abound in job creation and co-benefits like soil health. As the market evolves toward $2.85 billion by 2034, stakeholders must prioritize high-fidelity standards to ensure CDR’s role in a sustainable future.

References

- CDR Credit Sales Hit Record High, Powering Market Growth in 2025 – https://carboncredits.com/record-growth-in-cdr-credit-sales-drives-market-momentum/ (Published: Aug 11, 2025)

- Verra and S&P Global Commodity Insights to Advance Carbon Market Integration – https://verra.org/verra-and-sp-global-commodity-insights-to-advance-carbon-market-integration-with-next-generation-registry/ (Published: Aug 21, 2025)

- Verra’s Biochar and Forest Management Approaches Endorsed by ICVCM – https://verra.org/verras-biochar-and-forest-management-approaches-endorsed-by-icvcm-as-high-integrity-solutions/ (Published: Aug 13, 2025)

- Carbon Dioxide Removal Market Size to Hit USD 2,849.22 Mn by 2034 – https://www.precedenceresearch.com/carbon-dioxide-removal-market (Published: Feb 18, 2025)

- Voluntary carbon market surges in 2025, driven by CDR – https://www.linkedin.com/posts/carbon-credits_the-voluntary-carbon-market-just-had-its-activity-7361043804612689920-uvoM (Published: Aug 12, 2025)

- Global carbon removal sales 2024 – https://www.statista.com/statistics/1415539/carbon-removal-sales-worldwide/ (Published: Jul 14, 2025)

- ICVCM Approves Five IFM & Biochar Methodologies for CCP Eligibility – https://www.clearbluemarkets.com/knowledge-base/icvcm-approves-five-ifm-biochar-methodologies-for-ccp-eligibility (Published: Aug 19, 2025)

- ICVCM Backs Verra’s Biochar and IFM Methods as High-Integrity Climate Solutions – https://carboncredits.com/icvcm-backs-verras-biochar-and-ifm-methods-as-high-integrity-climate-solutions/ (Published: Aug 19, 2025)